The completed form and supporting documentation should be faxed to or , Attn Cheryl Kaba (or your contact) or email to 1099HelpDesk@USDAGOV (first line to attention f your ACPRB contact) If your request is received in COD/ACPRB by March 15, 10, a 1099 will be issued prior to April 15, 10Having completed the above steps, TaxSlayer Pro has applied the exemption amount for the type of entity and calculated the Taxable Income on the tax return The current exemption amount on a Form 1041 is $600 for a Decedents' Estate, $300 for a trust that is required to distribute all income currently, and $100 for all other trusts other than aFeb 26, 19 · Earnings reported by brokerages on a 1099DIV or 1099INT often go on the first page of your 1040 tax form, Smith says Earnings on a 1099MISC may be reported on your Schedule C, which denotes

1116 Frequently Asked Questions 1116 K1

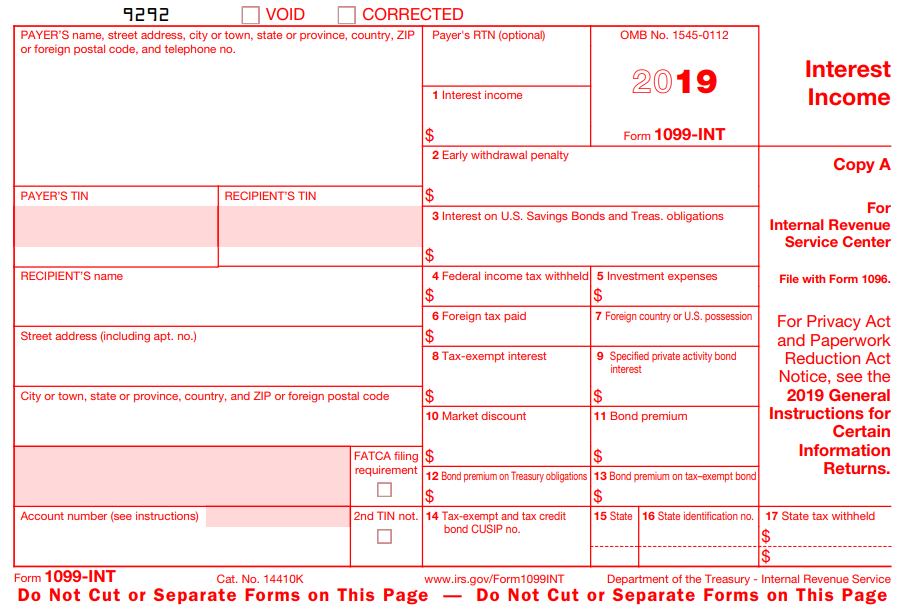

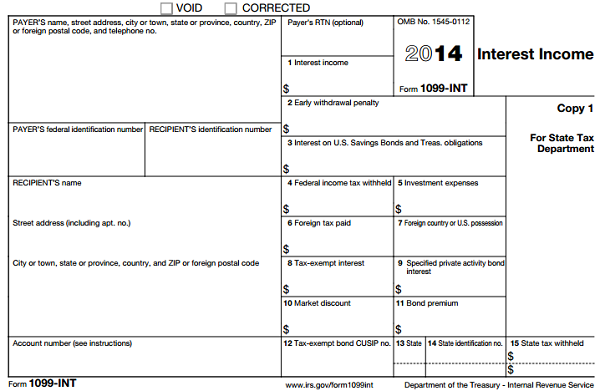

How to calculate 1099-int

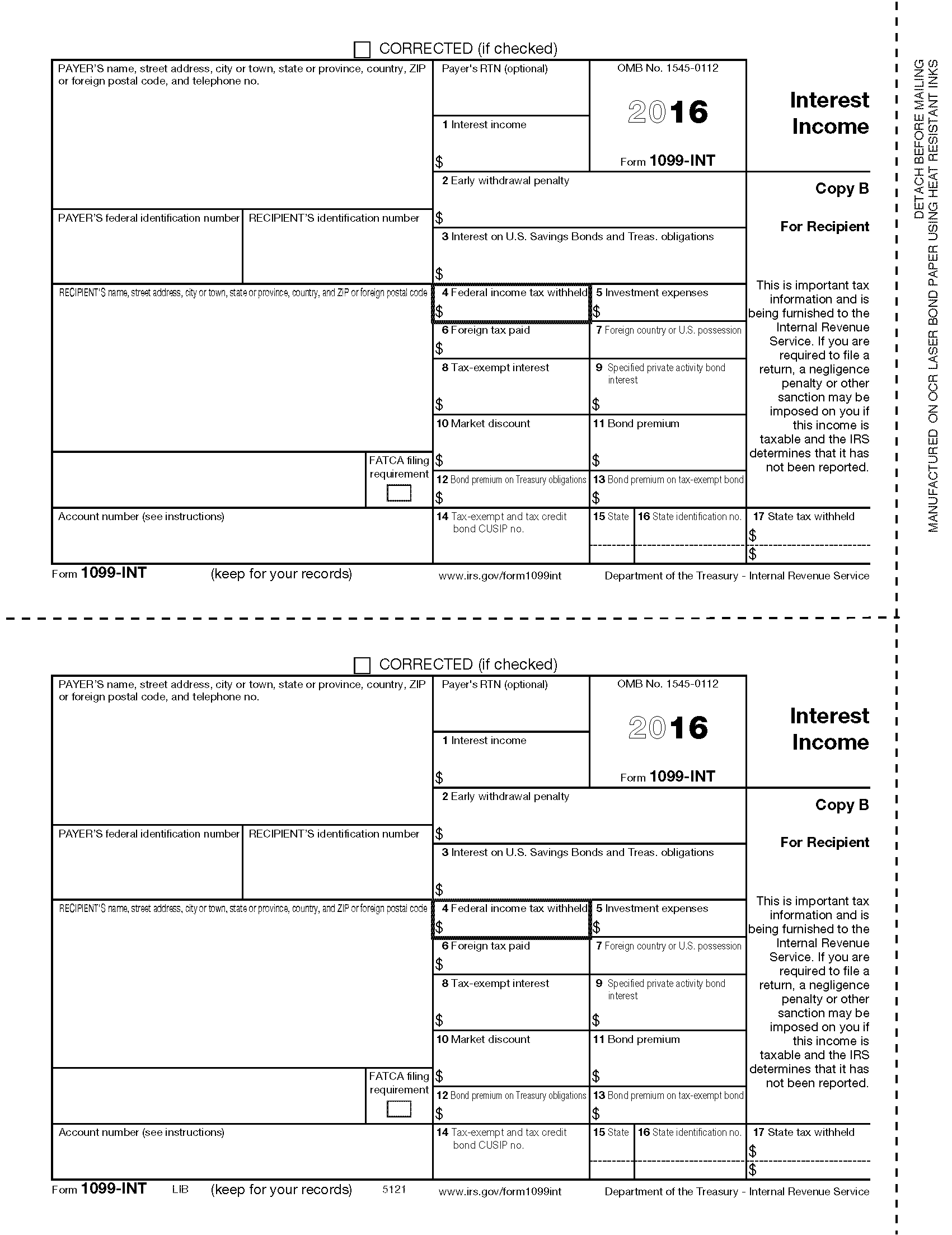

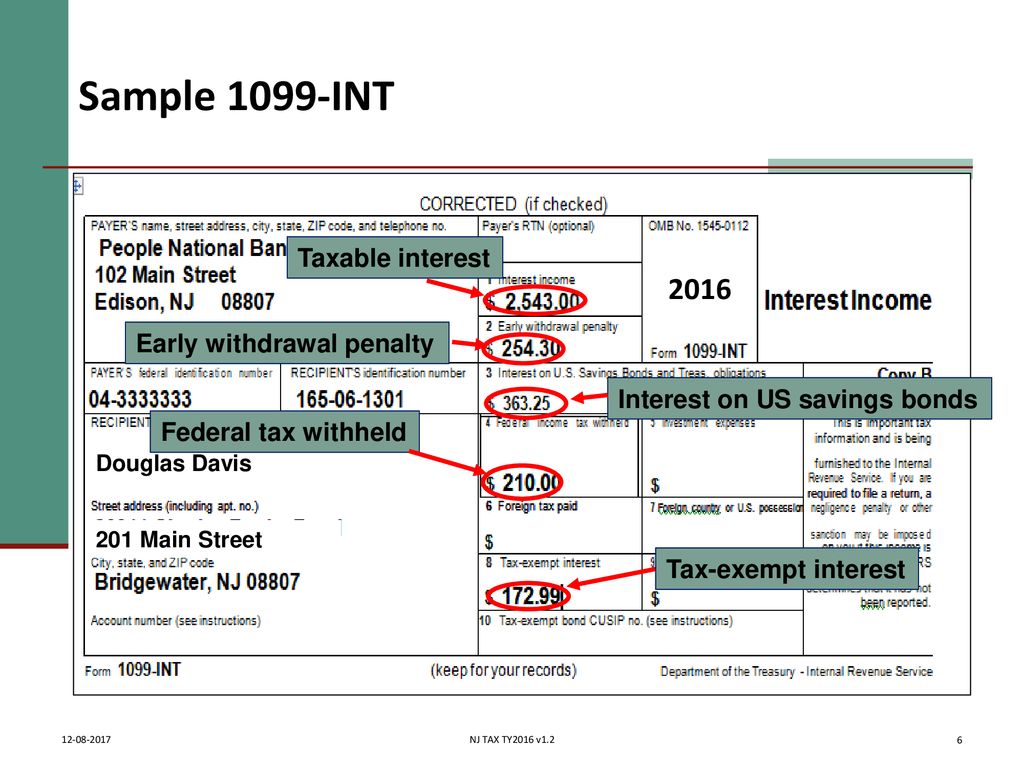

How to calculate 1099-int-Feb 18, 21 · The 1099INT form reports interest income you received during the tax year, and this is another relatively common 1099 It does not report dividends—they have their own 1099 You'll typically receive a 1099INT from your bank or credit union if you hold accounts that produced interest income of $10 or moreHttp//wwwexpresstaxfilingscomForm 1099INT for Interest Income is used to report interest payments made in the course of your trade or Business The 1099

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

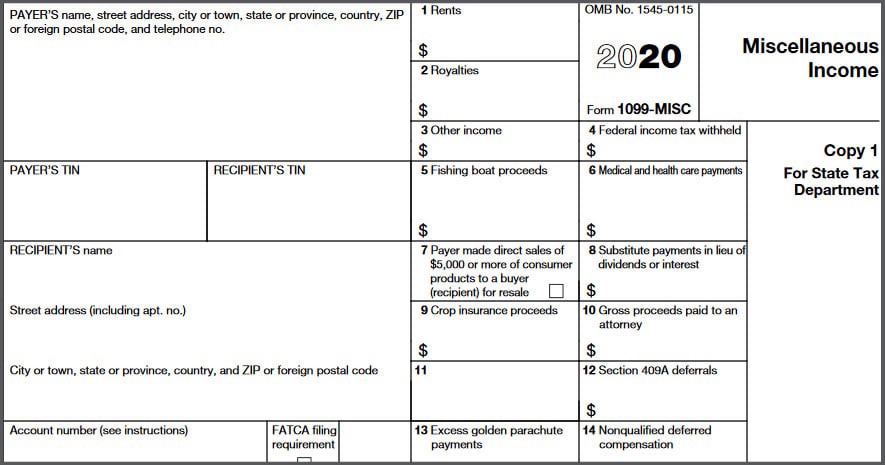

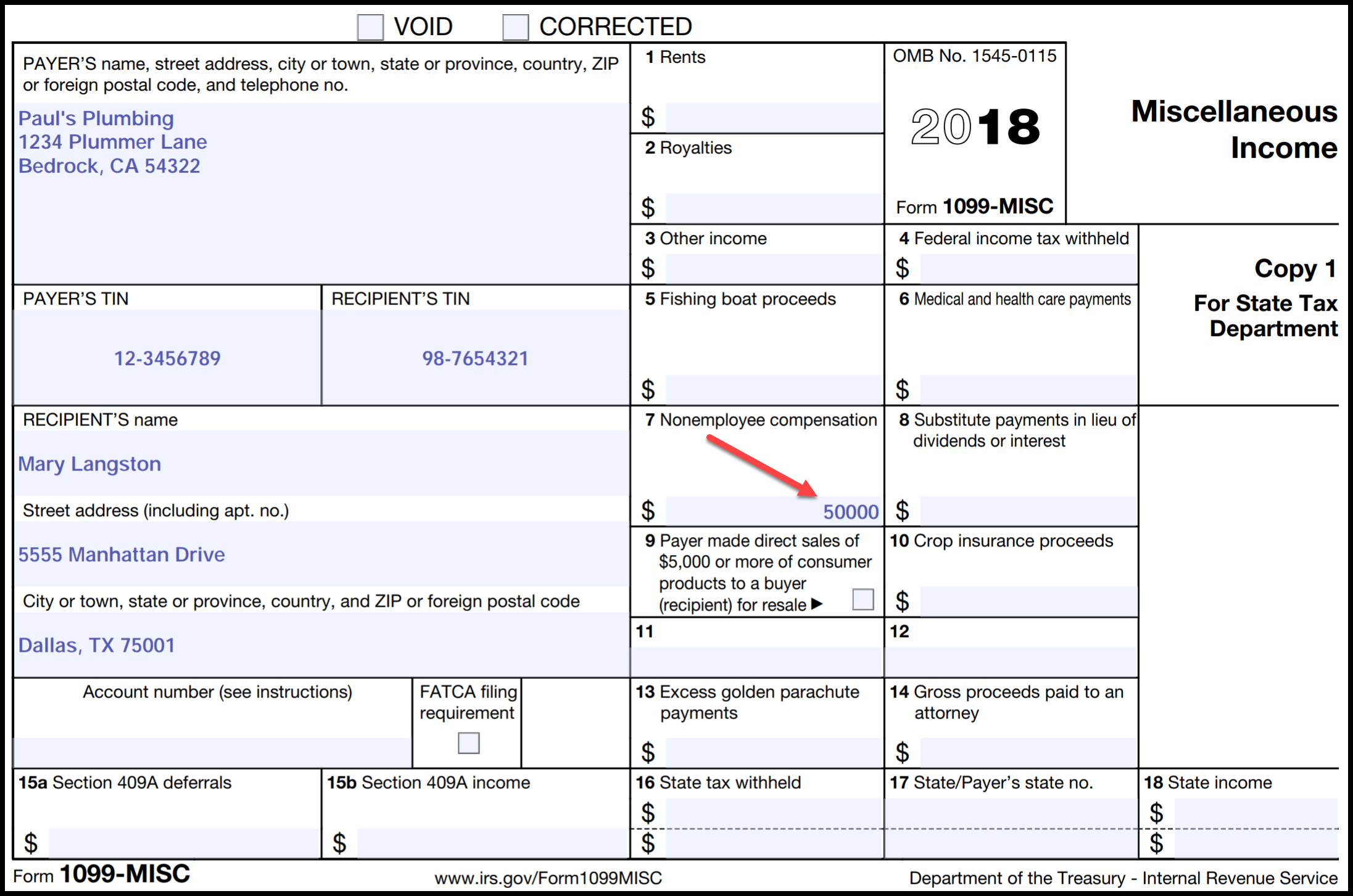

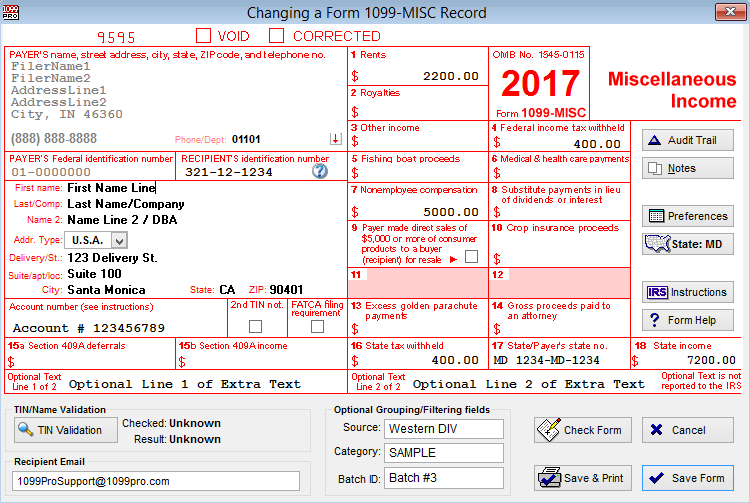

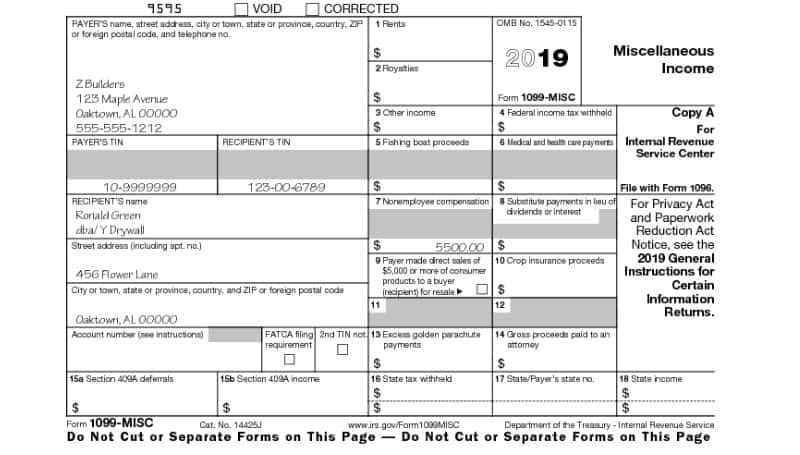

Form 1099 Misc Miscellaneous Income Definition

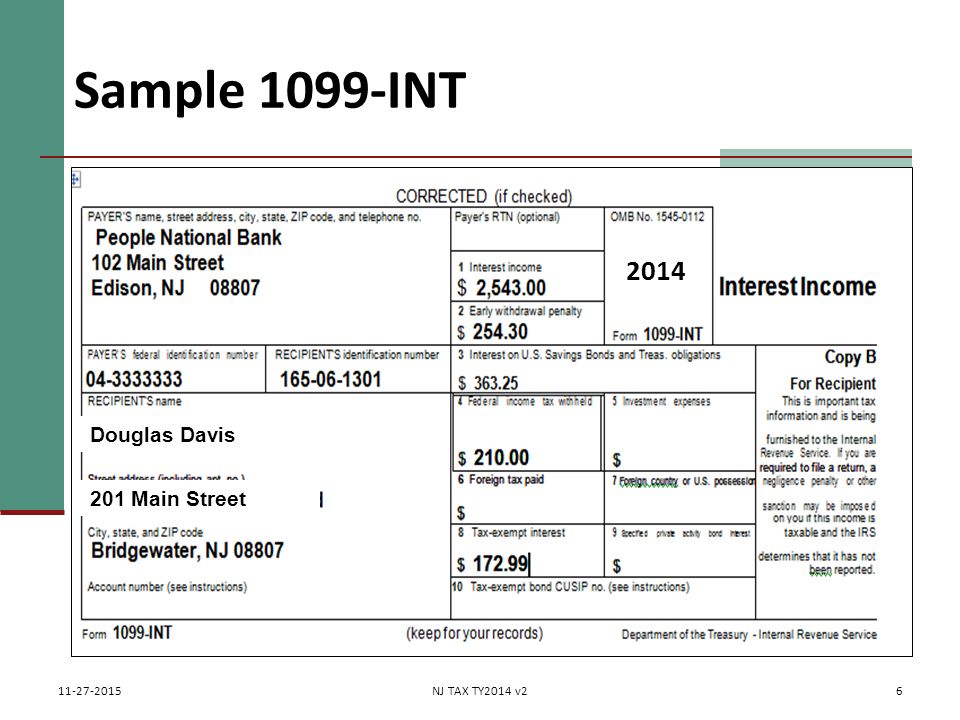

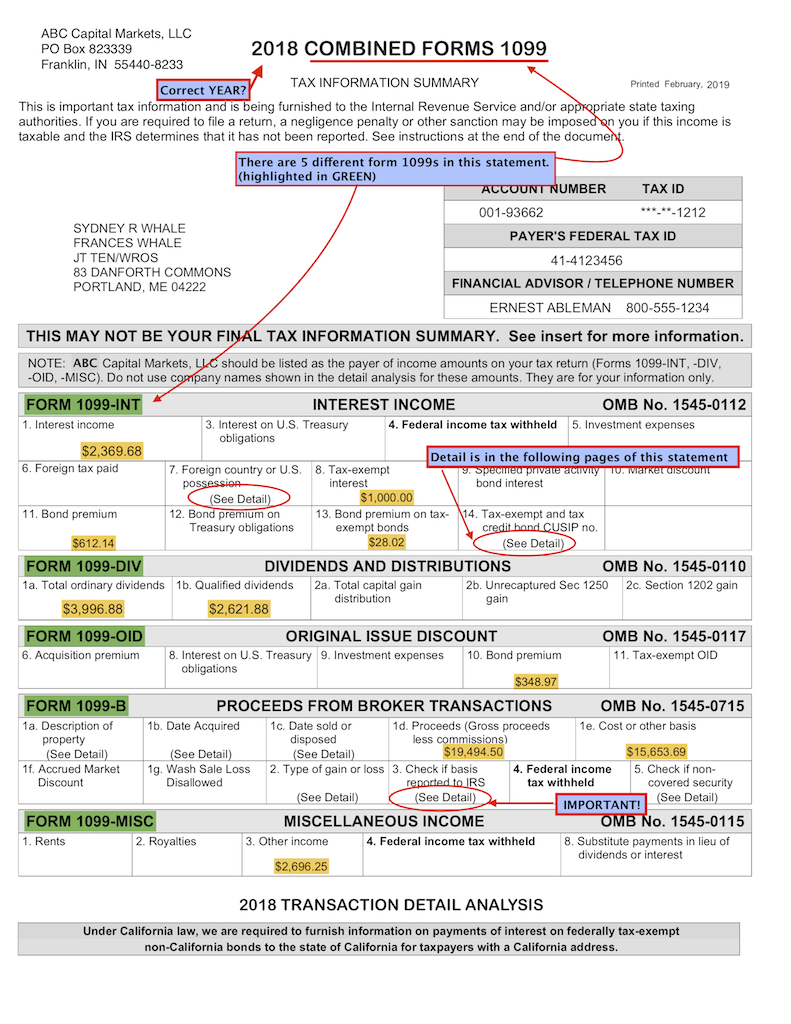

Health Savings Accounts (complete form using 1099SA info) 6 Enter the information from your paper form in the corresponding spaces on the 1099 form screen See the "Help" box on the upperright of the screen for more information about each entry 7 Click the green "Save" button at the bottom of the 1099 screen when it's completed1099DIV, 1099B, 1099INT, 1099MISC, and 1099OID, is delivered all in one place All form sections are displayed, even if there is no reportable information, so you will see a complete overview of your account(s) Summary Pages Reportable Summary Page Sample form image for informational purposes onlyJan 07, 21 · Instructions for How to Complete IRS Form 1041 Once you have the form, you can open them in the PDFelement How to fill Column A?

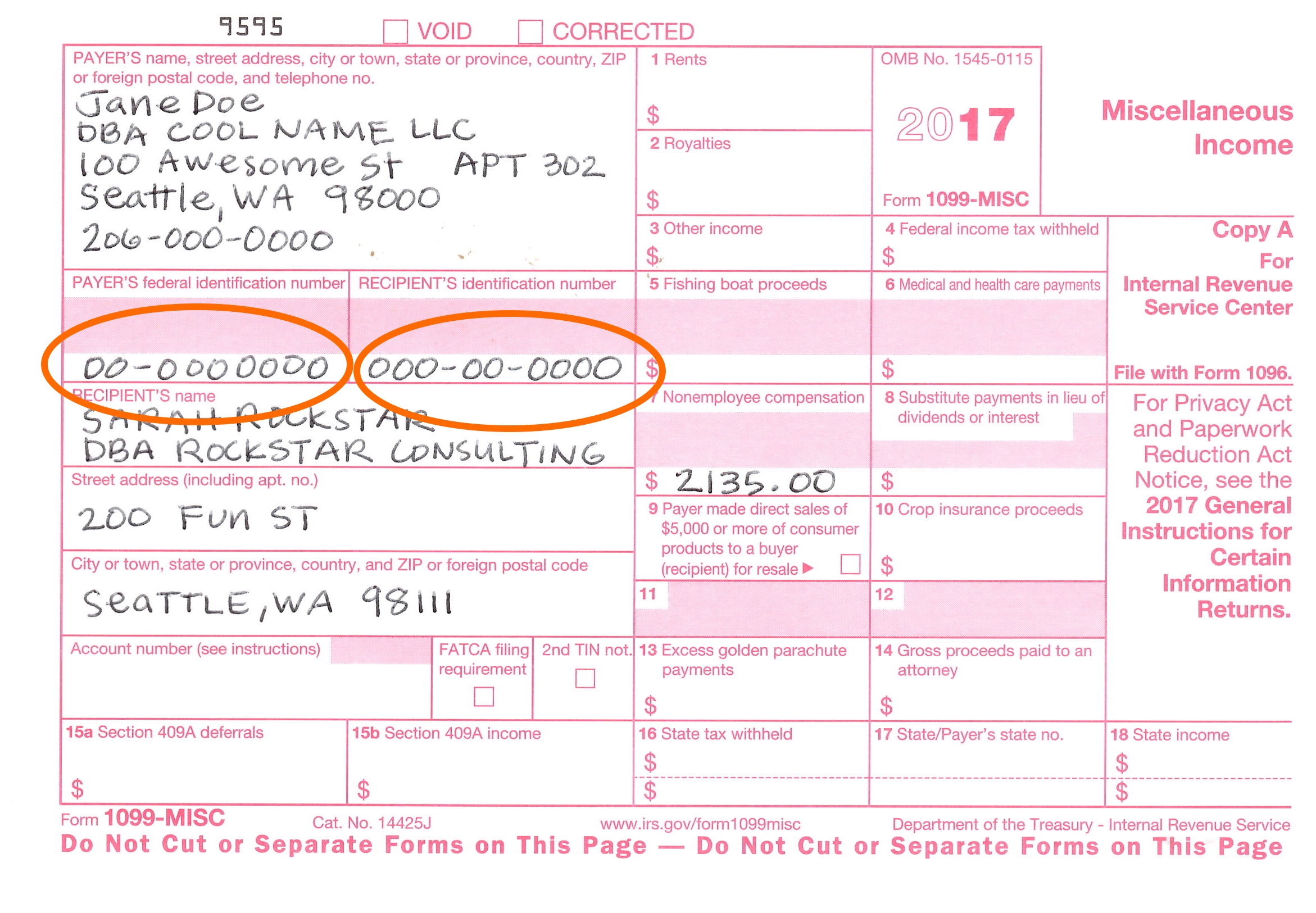

After you complete the form, you'll mail it back to the IRS by February 28 1099MISC Copy B–For the copy you'll send to the contractor, you can either fill out a physical copy of Form 1099MISC or print off an electronic version of Copy B from the IRS website Be sure to send the completed form to the contractor by January 31Prints 1099INT IRS Copy A on preprinted fillable IRS approved 1099INT forms Prints Recipient copies on blank paper (see SAMPLE OUTPUT below) or fillable 1099INT forms Exports 1099INT forms to CSV text files compatible with Excel 1099INT forms can be rolled foward from yeartoyear at your option Supports an unlimited number of 1099Form 1099MISC 12 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city, state, ZIP code, and telephone no

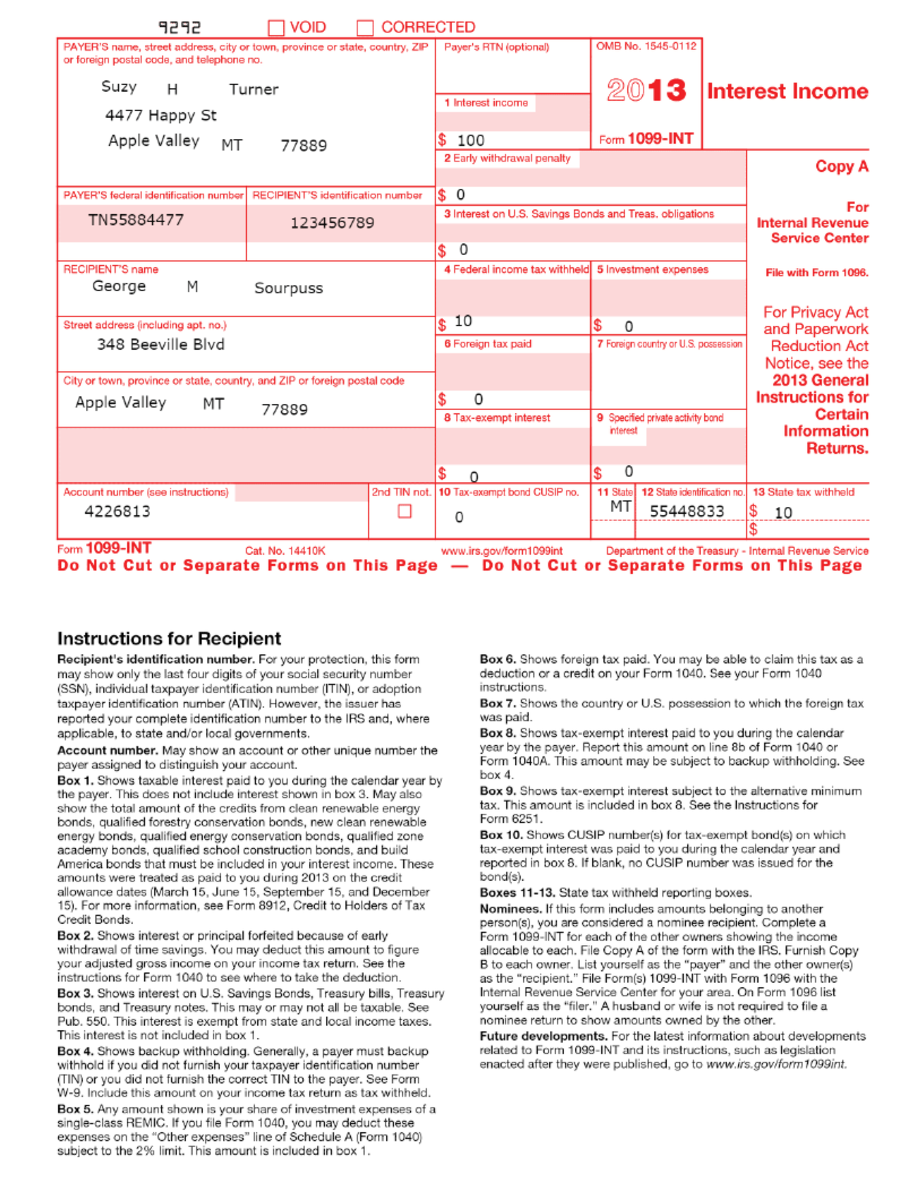

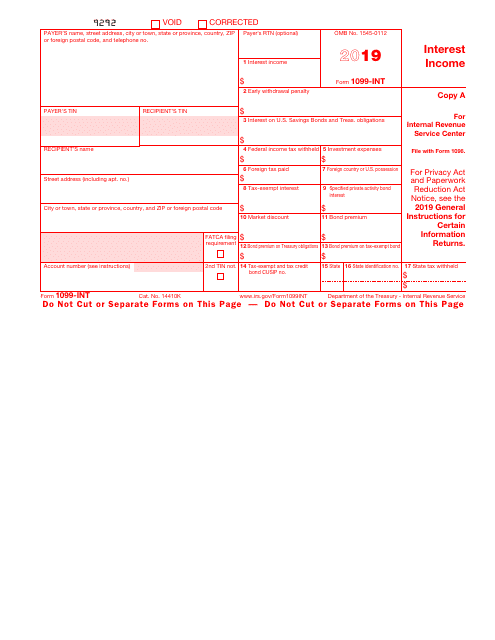

Stick to the fast guide to do Form 1099 INT, steer clear of blunders along with furnish it in a timely manner How to complete any Form 1099 INT online On the site with all the document, click on Begin immediately along with complete for the editor Use your indications to submit established track record areas Add your own info and speak to dataSchedule B is an IRS tax form that must be completed if a taxpayer has received interest income and/or ordinary dividends over the course of the yearIRS Form 1099INT is sent to those taxpayers who received interest income during the current tax year, such as that from a savings account This article is written from the point of view of the entity filling out the 1099INT, not the person receiving it

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

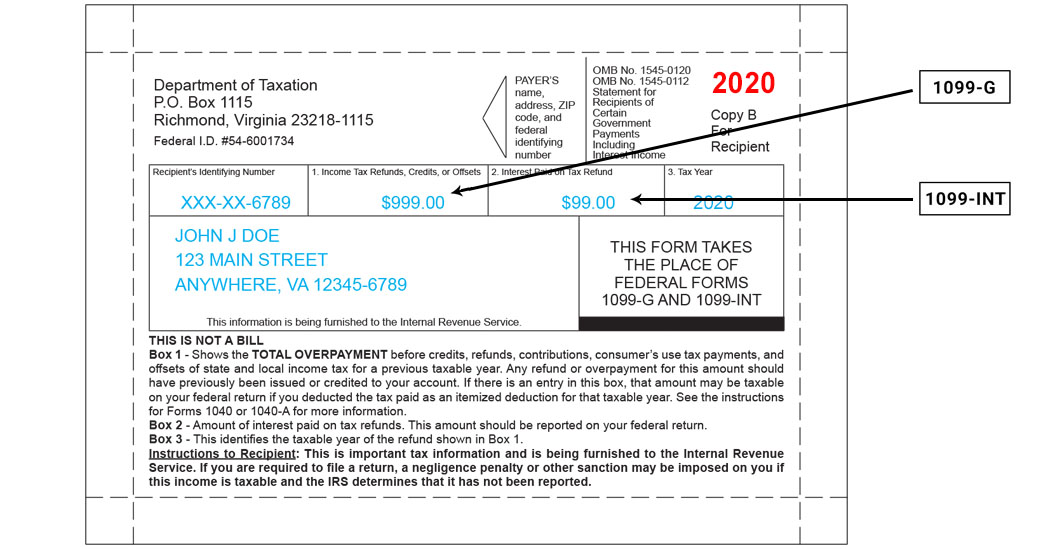

Your 1099 G 1099 Int What You Need To Know Virginia Tax

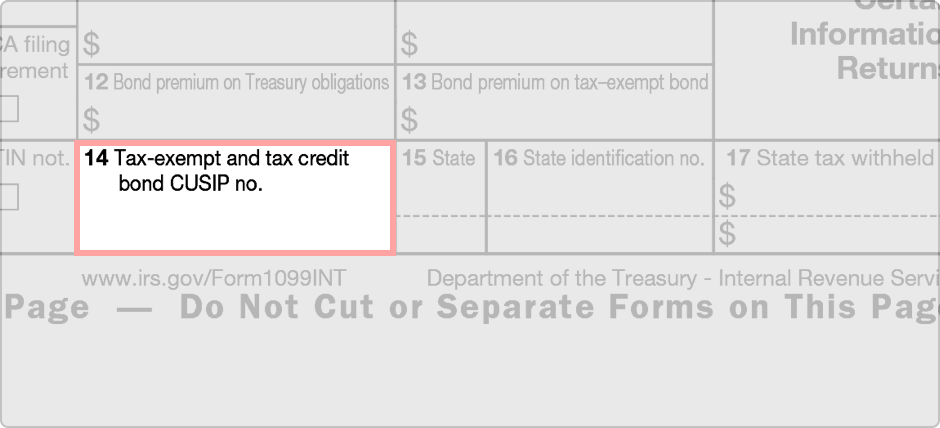

Form 1099INT is sent to the taxpayer to show interest income earned during the tax year Different types of interest received may include savings bond interest, checking and savings account interest, and/or interest earned on Treasury billsThe issuer has reported your complete TIN to the IRS FATCA filing requirement If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting • The 21 Instructions for Forms 1099INT and 1099OIDUsing Your W2 and Form 1099INT to File Your 1040EZ In this simulation, you will take on the role of Tasha Miller in order to learn how to use the information from Forms W2 and 1099INT to complete Form 1040EZ

1099 Int A Quick Guide To This Key Tax Form The Motley Fool

1099 Int Payer Copy C Or State

Dec 16, · A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to completeJun 07, 19 · If the amount is less than $10, the bank does not have to send you a 1099INT, but you are required to report the income You report it as if the bank had sent you a 1099INT Just put the bank name as the payer and put the interest in Box 1 View solution in original post 2 15 75,025 Reply thompsondcJan 07, 14 · There are several variations of the 1099 form, so simply asking what is a 1099 form will not get you the answer you might be looking for As a US business owner, you probably have issued a 1099 independent contractor tax form to some of your employees or a 1099INT for interest income that you may receive from your bank However, for today's purposes, the article

1099 Int Template Create A Free 1099 Int Form

How To Read Your 1099 Robinhood

1099 Form Printable 18 Fill out, securely sign, print or email your 1099 INT Fillable Form 1718 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Feb 01, 19 · To err is human Everyone out there makes a mistake at some point in time However, the ultimate thing is to correct the committed mistake As a tax filer also you can commit some mistakes while filing 1099 tax forms It is common and the IRS understands the situation better and gives a chance to correct the submitted forms There may be a condition where you find theJun 03, 19 · If you received interest from a personal loan, YOU do not complete a 1099INT If anybody completes one, it is the person paying you the interest But individuals do not usually have to file a 1099INT, just banks and similar companies You report the interest from your own records

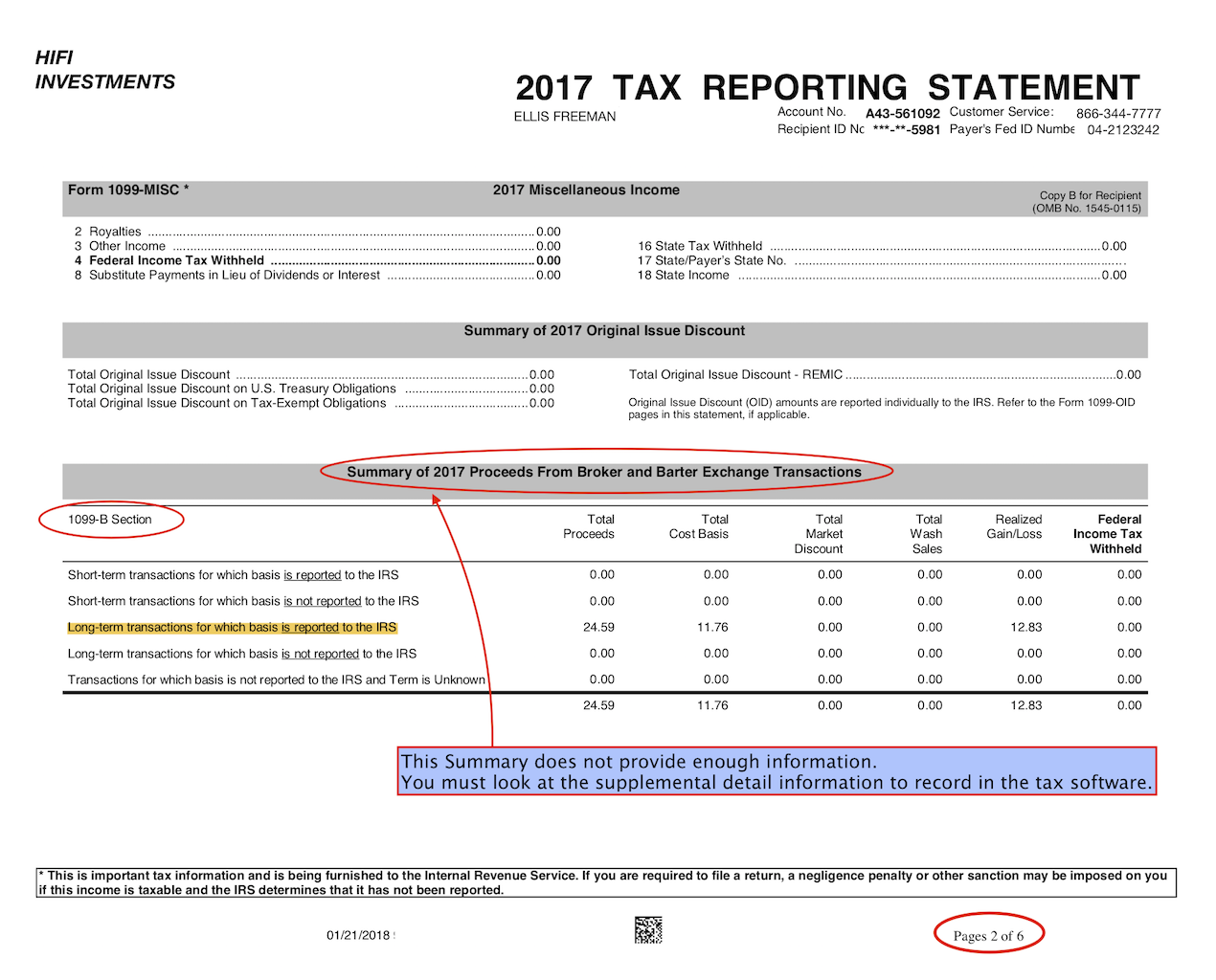

Brokerage Statements

1116 Frequently Asked Questions 1116 K1

The 1099INT you receive from the Trust is like any other 1099INT you receive from your bank or financial institution Take the number in Box 1 of your 1099INT and enter this amount ($2,000 in the SAMPLE) on Form 1040, Schedule B, Part I, line 1 and complete part I,Significance for payee's tax return Payees use the information provided on the 1099 forms to help them complete their own tax returnsIn order to save paper, payers can give payees one single Combined Form 1099 that lists all of their 1099 transactions for the entire year Taxpayers are usually not required to attach Form 1099s to their own Federal income tax returns unless theApr 12, 21 · A 1099INT tax form is a record that a person or entity paid you interest during the tax year Sometime in February, you might receive a

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Form 1099 Nec What Is It

Your Ultimate Guide To 1099s

Data, put and ask for legallybinding electronic signatures Work from any gadget and share docs by email or fax Try out now!Check all the boxes that are applicable in Column A Where to Enter Your Personal Details To the left, you need to enter the details including the name and address of the estateForm 1099INT is the IRS tax form used to report interest income The form is issued by all payers of interest income to investors at yearend It includes a breakdown of all types of interest

Form 1099 Int Interest Income Irs Copy A

1099 Int Software To Create Print E File Irs Form 1099 Int

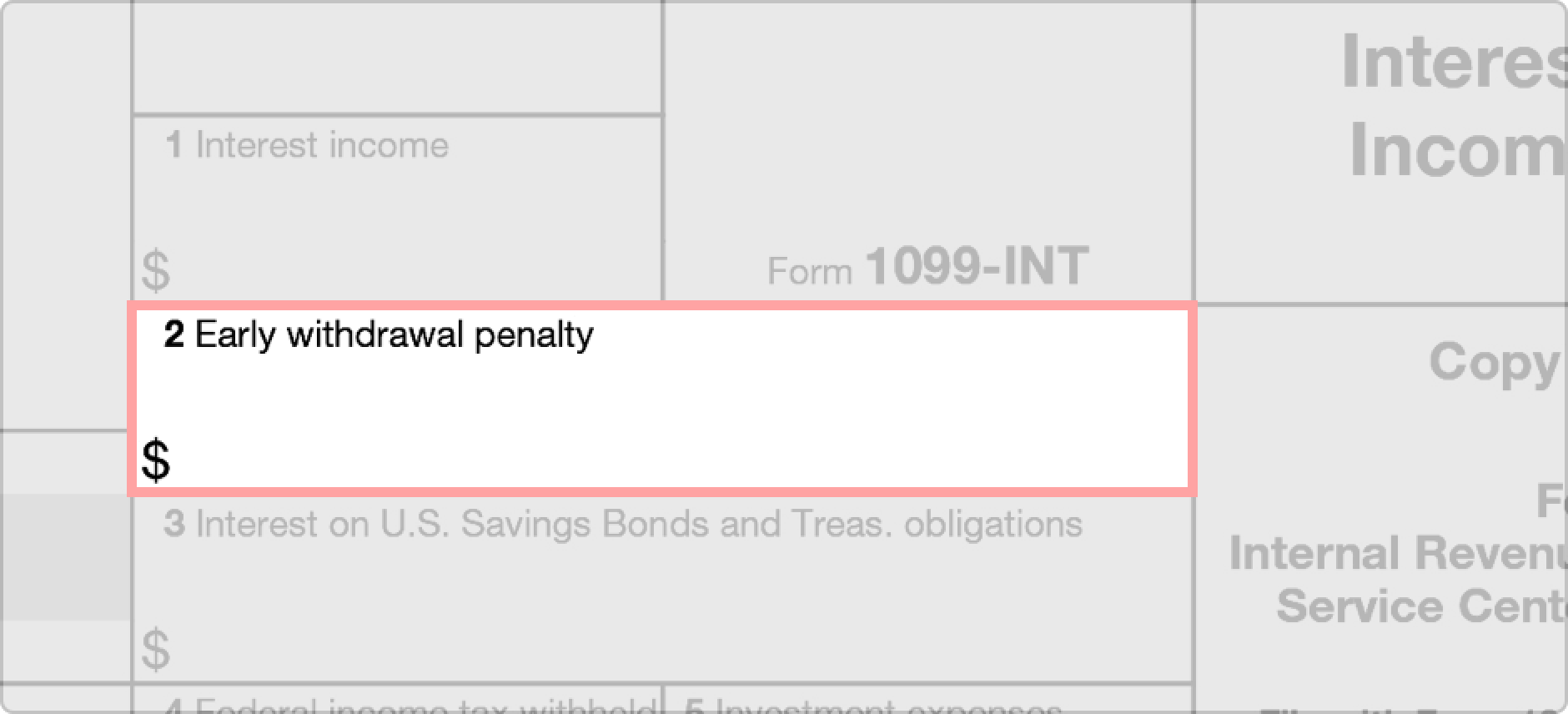

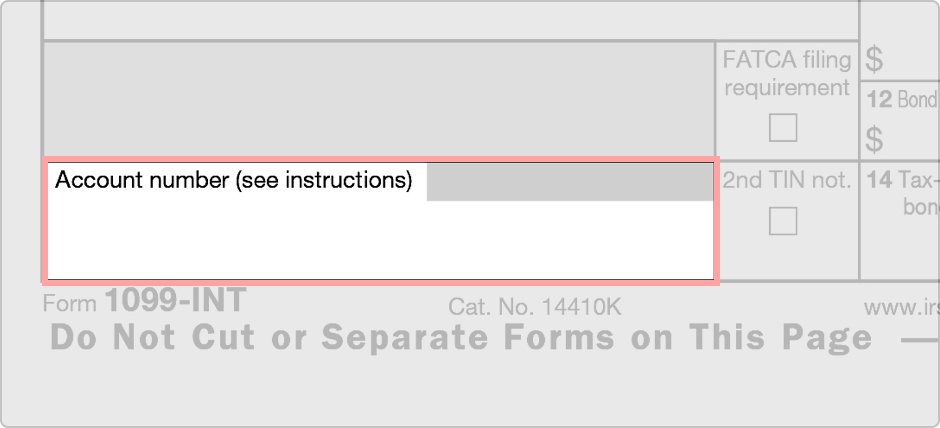

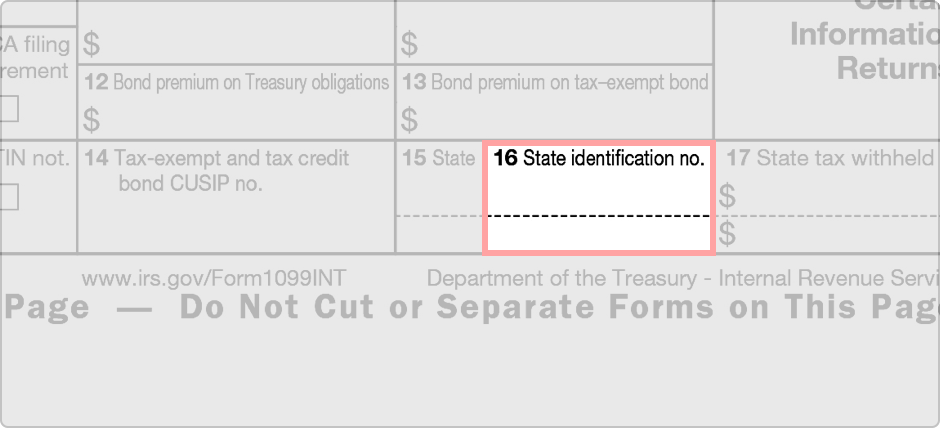

STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation"Jan 06, 21 · File Form 1099INT for each person To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10 For whom you withheld and paid any foreign tax on interest From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the paymentDec 08, · The 1099INT is a short form as IRS tax forms go When an entity is required to issue this form, it must provide three copies — one to the IRS, one to the individual receiving the interest, and one to the state tax department On the left side of the Form 1099INT are boxes for

1099 Int Form Fillable Printable Download Free Instructions

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

To see a Sample 1098 T, Click here Form 1099INT Earnings for interest from a bank account or certificate of deposit are reported on this form Even if you have received the income and don't have it in your hand, reinvested earnings are still taxable 1099INT statements are also issued for those who have cashed in savings bonds1099int sample Take advantage of a electronic solution to develop, edit and sign documents in PDF or Word format on the web Turn them into templates for numerous use, incorporate fillable fields to gather recipients?Feb 26, 21 · When you file your taxes, use Form 1099H to help you complete Form 85, which is where you report the premium payments you received during the year Learn about other ways you can get help paying for health insurance premiums Form 1099INT, Interest Income The 1099INT is used to report income you earned as interest during the year

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

Interest Dividends Pub 17 Chapters 7 8 Pub 4012 Tab D Ppt Download

According to the Instructions for Forms 1099INT and 1099OID, taxable interest for the 1099INT is $10 or more of interest paid out This interest can be garnered from a US account or a foreign account Exempt Account Holders and Accounts Individual account holders are exempt from receiving a 1099INTFeb 10, 19 · Sample Completed 1500 Claim Form Sample Form 1099 Int Sample Form 1099 Q Sample Form 1099 R Sample Form 1099 S Sample Form 1099 Sa 1099 Misc Template 16 Word Inspirational Sample 1099 Form Luxury 24 Fresh Image 1099 Form Template Word Sample 1099 Form Filled OutNov , · Document your efforts to obtain a completed W9 form by keeping notes of the attempts you made, including emails and mailings You can file the 1099NEC using zeros in the space where the taxpayer ID is required if the individual simply won't give you the number You might want to reconsider using their services and paying them going forward

Brokerage Statements

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Sep 03, 19 · When I switched from a sole proprietorship to an LLC in 19, one of the biggest hurdles I hit was figuring out how to fill out a W9 as a singlemember LLC *Disclaimer I am not a tax professional, so the following is not tax advice Please seek the advice of an accountant or other qualified professionalLearn how to fill out your Schedule K1 quickly and accurately If you operate a passthrough entity, you must fill out a Schedule K1 tax form This form liForm 1099INT 13 Interest Income Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the Internal Revenue Service If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS

Schwab Moneywise Calculators Tools Understanding Form 1099

16 Instructions For Form 1099 Int Best Of Sample Int Form Exceptional 1099 Templates Chase Free 17 Models Form Ideas

If the foreign tax paid is reported on a Form 1099INT, Form 1099DIV, or Schedule K1 completion of the entire Form 1116 may not be required If the foreign tax paid is a result of living and working outside the US, then all the questions on Form 1116 need to be addressed1099DIV Sometimes, the individual sections of the composite forms do not include all of the information that is available on a standard 1099 form, such as the check boxes for shortterm and longterm transactions on the standard 1099B form Instead, many of these composite forms simply group the different types of transactions4 1099INT for INTEREST paid _____ 5 LEGACY 1099MISC 19 and before / Not for Other Income, Nonemployee Comp and Rent 6 LEGACY ATTORNEY 1099MISC 19 and before / Not for All templates include Box 4 Federal Tax Withheld Only

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099INT filing requirements When you file your taxes, you don't need to attach copies of the 1099INT forms you receive, but you do need to report the information from the forms on your tax return That's because each bank, financial institution or other entity that pays you at least $10 of interest during the year must prepare a 1099INT,17 have completed Form I864A I am filing along with this affidavit all necessary Form I864As completed by these people 7 $ Enter the current cash value of the principal immigrant's stocks, bonds, certificates of deposit, and other assets not included in Item Number 6 or Item Number 7 8 $ Part 6 Sponsor's Employment and IncomeJan 16, 21 · The Form 1099INT shows how much interest a person earned from an institution in a tax year The IRS requires brokerage firms, banks, mutual funds and other financial institutions to file Form 1099s on interest they pay during the year (the minimum interest paid to trigger a Form 1099INT is $10)

1099 Int 19 Public Documents 1099 Pro Wiki

Form 1099 Int Software 79 Print 2 Efile 1099 Int Software

Nov 07, 13 · Any organization that has paid interest income, withheld foreign tax on interest or withheld federal tax under the backup withholding rules must file IRS Form 1099INT Form 1099INT was revised in 12 The top of the form shows the payer name and address and TIN followed by the recipient name, address and TINRequesting Form W9 to be completed is the standard process that the IRS has created for payers to obtain the TIN numberCONCLUSION Vendors are not required to submit a Form W9, however, the likely result would be a 24% reduction in the payment to them by their customerExamples of Information ReturnsExamples of information returns that useFeb 14, 18 · For most taxpayers, Form 1099INT is easy to understand, but there's a lot of detail that can complicate things in some cases Here, you'll find

Oid Calculator Tutorial

Understanding Tax Form 1099 Int Novel Investor

How To Fill Out And Print 1099 Nec Forms

1099 Int Recipient Copy B

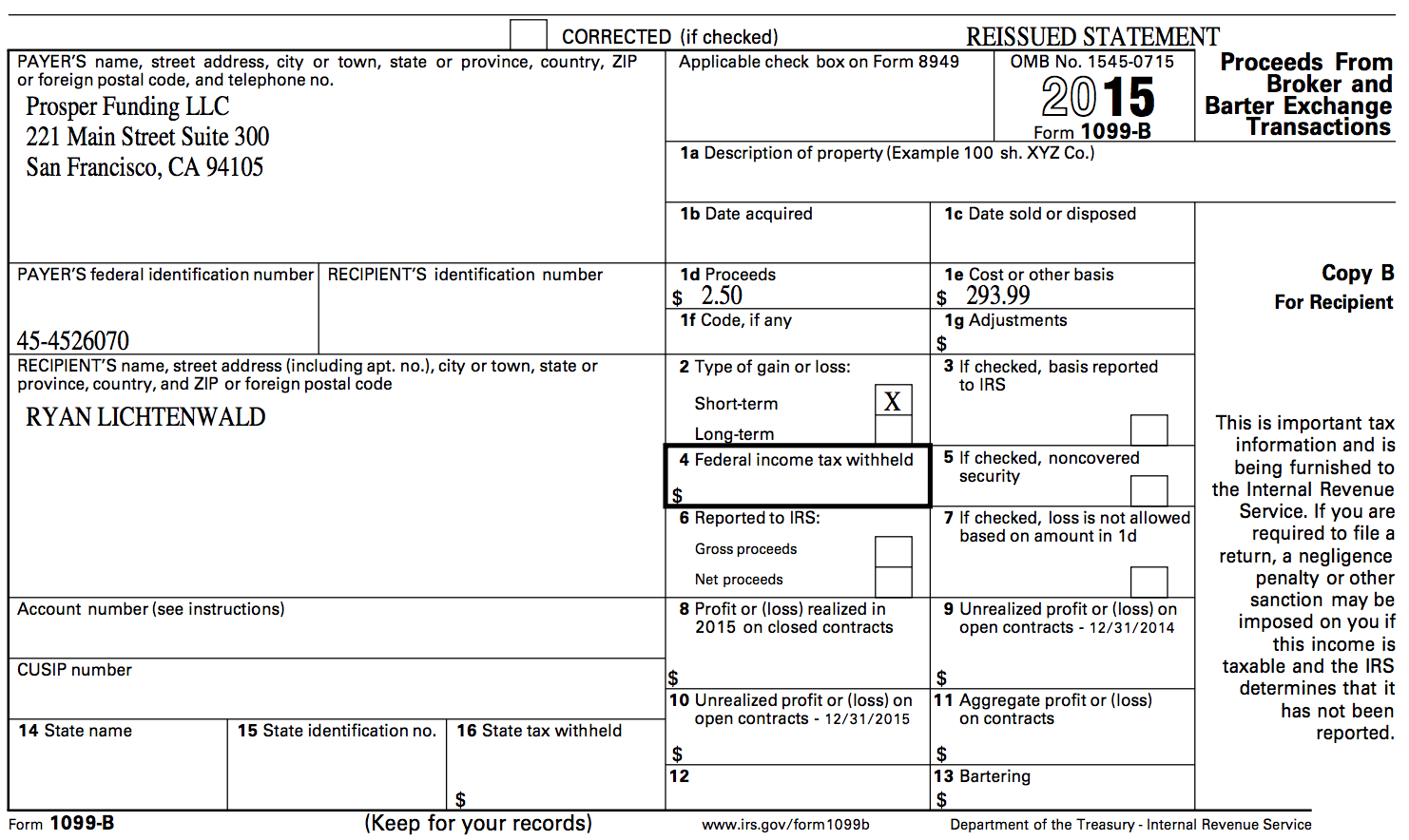

Lending Club And Prosper Tax Information For 16 Lend Academy

1099 Int Form Fillable Printable Download Free Instructions

Missing An Irs Form 1099 Don T Ask For It

Surviving The Tax Season How To Read Form 1099 B

1099 Misc Form Fillable Printable Download Free Instructions

Irs Form 1099 Int Download Fillable Pdf Or Fill Online Interest Income 19 Templateroller

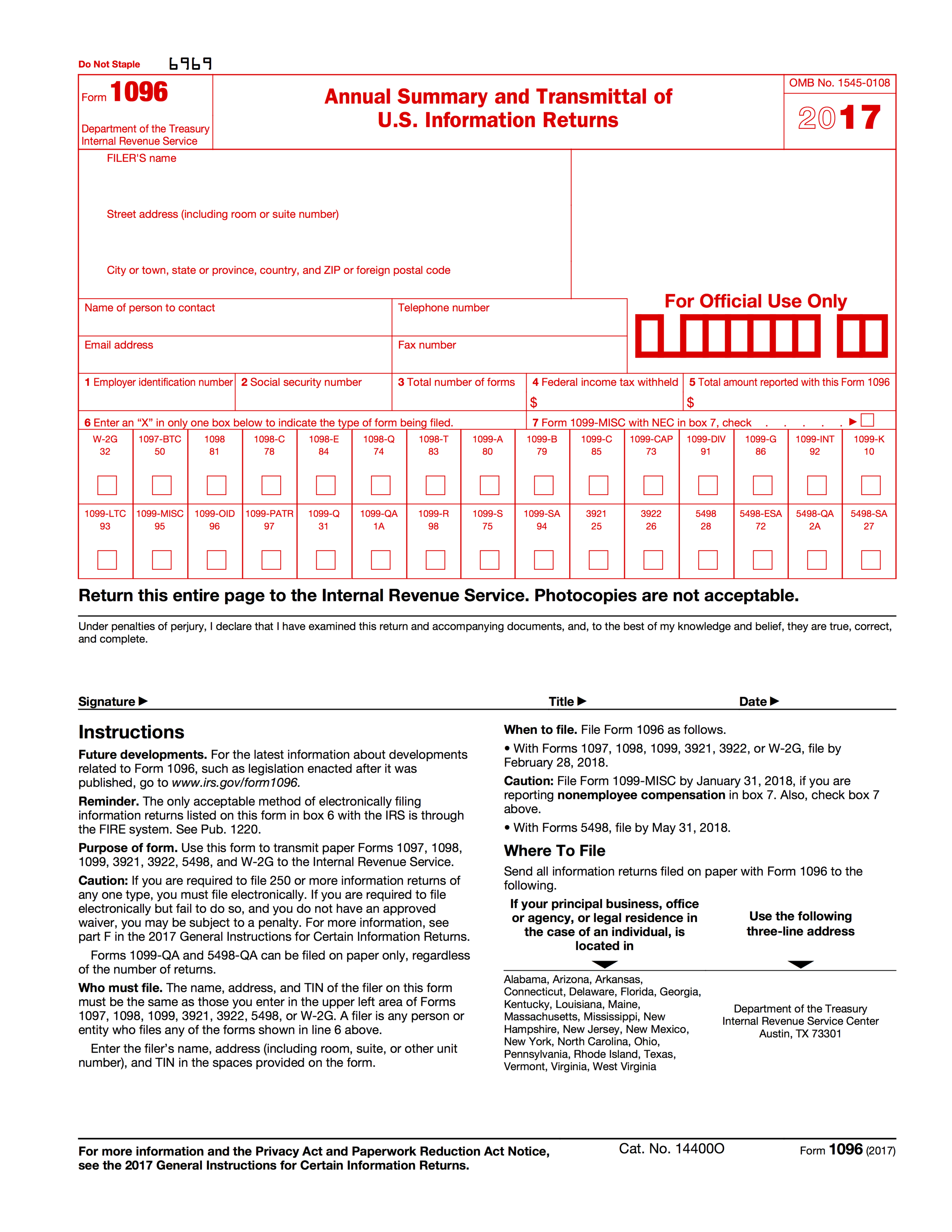

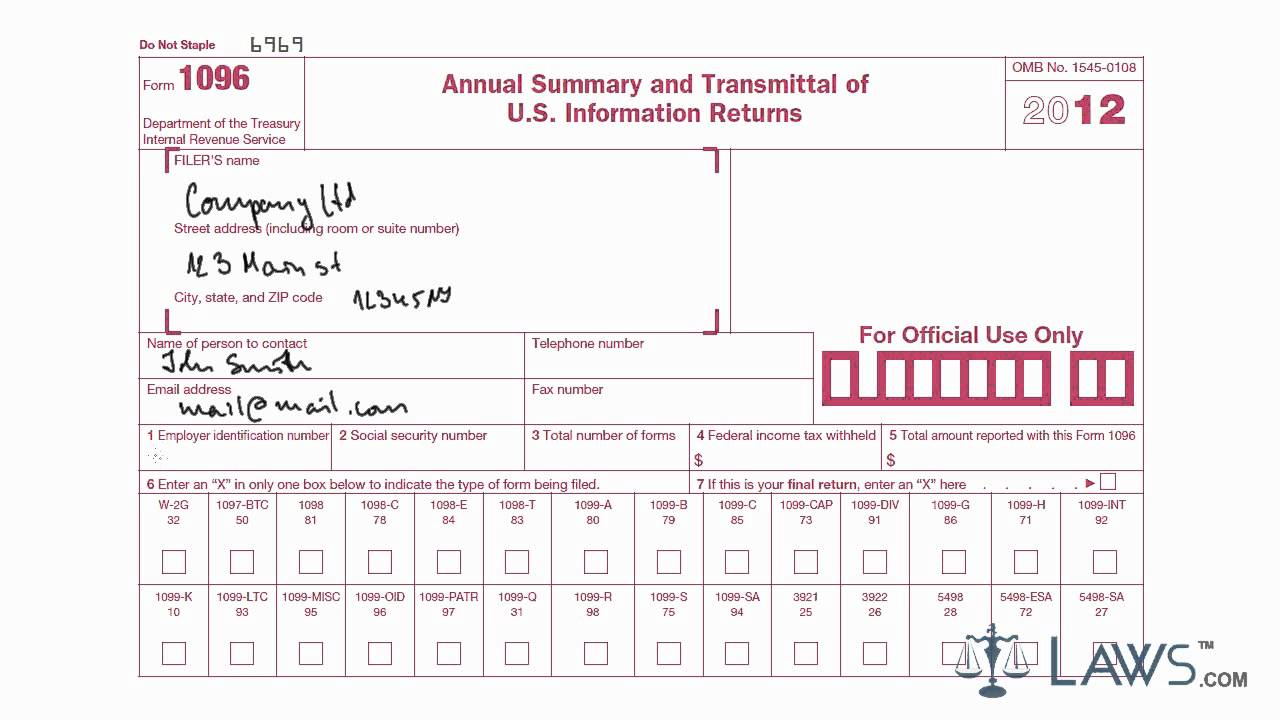

Learn How To Fill The Form 1096 Annual Summary And Transmittal Of U S Information Return Youtube

Interest Dividends Pub 17 Chapters 7 8 Pub

1099 Int Your Guide To A Common Tax Form The Motley Fool

Online Irs Form 1099 Int 17 18 Irs Forms Irs Form

Understanding 1099 Form Samples

1099 Int Form Fillable Printable Download Free Instructions

Understanding 1099 Form Samples

How To File 1099 Misc For Independent Contractor

1099 Int Your Guide To A Common Tax Form The Motley Fool

Klauuuudia 1099 Misc Template

Form 1099 Int Pdf Abcgray

1099 Nec Form Copy B 2 Discount Tax Forms

1116 Frequently Asked Questions 1116 K1

Form Irs 1099 Int Fill Online Printable Fillable Blank Pdffiller

Terrific Taxation Task

1099 Int Recipient Copy B Forms Fulfillment

Brokerage Statements

1099 Nec Software Print Efile 1099 Nec Forms

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

What Is A 1099 Int Tax Form How Do I File It

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Understanding 1099 Form Samples

Free Fillable 1099 Int Form

Form 1099 Nec For Nonemployee Compensation H R Block

January 10 Consumerec Blog

How To Fill Out And Print 1099 Nec Forms

1099 Tax Software Blog 1099 Software How Can I Print Form 1096

How To Fill Out 1099 Misc Irs Red Forms

Accessing Your 1099 G Sc Department Of Employment And Workforce

Tax Information Center Fidelity Institutional

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Int Interest Income Definition

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc It S Your Yale

Understanding Your Tax Forms 16 1099 B Proceeds From Broker Barter Exchange Transactions

1099 Int Form Fillable Printable Download Free Instructions

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Online Irs Form 1099 Int 17 18 Irs Forms Irs Form

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

Understanding 1099 Form Samples

1099 Int A Quick Guide To This Key Tax Form The Motley Fool

1099 Misc Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Online Irs Form 1099 Int 17 18 Irs Forms Irs Form

How To Calculate Taxable Amount On A 1099 R For Life Insurance

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Form 1099 Int Prepared By Quick Easy 1099 W2

Sample 1099 Misc Forms Printed Ezw2 Software

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

Breaking Down Form 1099 Div Novel Investor

1099 Int Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/Form1099-aeb4be046fe64c148a594971594ece90.png)

What Is Form 1099

16 Instructions For Form 1099 Int New 1099 Int Form Wells Fargo Chase Resume Exa Pantacake Models Form Ideas

Interest Dividends Pub 17 Chapters 7 8 Pub 4012 Tab D Ppt Download

No comments:

Post a Comment